If you spend your entire salary as soon as you get it, there is no savings in your account by the end of the month, and there is tension about money during an emergency, then it is very important for you to understand personal finance!

Imagine, if you have a strong financial plan—savings, investments, and emergency fund—then how stress-free life can be! This article will explain the 5 basic components of personal finance and teach you the right management of money so that you can become financially strong.

Table of Contents

ToggleWhat is Personal Finance ?

Personal finance means managing your income, expenses, savings, investments and debt properly. If you want financial freedom, then it is very important to understand personal finance.

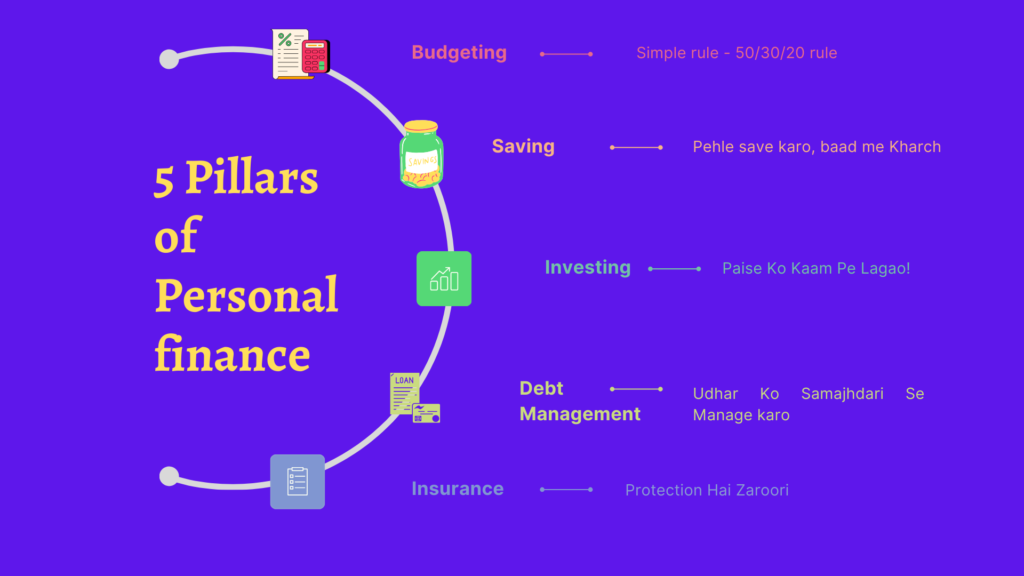

5 Pillars of Personal Finance

1. Budgeting – Money management

Budgeting means tracking income and expenses so that you can control extra expenses.

Simple rule – 50/30/20:

Tip: Use notebook, budgeting apps or Excel sheet so that you can regularly track the right management of money.

2. Saving – If you save money today, it will be useful tomorrow!

Saving means keeping money aside for the future so that emergencies and short-term goals can be managed.

✔ Emergency Fund – It is important to save for at least 3-6 months of expenses (Fixed Deposit or Liquid mutual funds are best).

✔ Short-Term Goals – Keep separate savings for travel, gadgets or education (Savings account is right).

📢 Rule: Save first, spend later!

3. Investing – Put your money to work!

Just saving will not suffice, investing is a must so that money can grow.

✔ Stocks, Mutual Funds, Index Funds – To create long-term wealth.

✔ PPF, NPS, Gold Bonds – Secure and tax-saving investments.

✔ SIP vs. Lumpsum – Invest in SIP every month so that the risk is reduced.

💡 Tip: Start early, reap the benefits of compounding!

4. Debt Management – Manage debt with prudence

If you have a loan or credit card debt, pay it off on priority:

✔ Finish high-interest debt first – like credit card dues.

✔ EMI should not be more than 30-40% – so that there is no financial stress.

✔ Snowball vs. Avalanche Method – Pay off small loans or high-interest loans first.

📢 Golden Rule: The sooner you finish the debt, the better your financial future!

5. Insurance – Protection is a must

Without insurance, financial planning is incomplete!

✔ Term Life Insurance – If you are an earning member, then life insurance is a must. It keeps the family financially secure.

✔ Health Insurance – Medical emergencies are unpredictable. Get a good health cover so that you can avoid hospital bills.

💡 Tip: Insurance is not an expense, it is a necessity! First insure, then invest.

Common Financial Mistakes that you should avoid

❌ Not tracking expenses

❌ Just earn, but do not save and invest

❌ Using credit card without thinking

❌ Taking personal loan without thinking

❌ Ignoring insurance – the biggest mistake

Actionable Steps – Start today!

✅ Set your budget and start tracking expenses. (Excel, budget tracking tool, notebook)

✅ Save something every month. (Minimum 10% of your salary)

✅ Start investing with a small amount (Mutual Funds, ETFs, Bonds, Stocks)

✅ Get rid of high-interest debt quickly (credit card loans and personal loans)

✅ Get health and term insurance (very important)

Conclusion

Take the first step today! If you learn the right management of your money, you will never face financial problems. You can create a strong financial future by maintaining a balance between budgeting, saving, investing, debt management and insurance. Start today and achieve your financial goals!