Table of Contents

Toggle50/30/20 Budget Rule: Best Budgeting Strategy for Salaried Individuals

Budgeting Kyu Zaroori Hai?

Aap kitna bhi kama lein, agar aapka paisa bina kisi planning ke kharch ho raha hai, toh financial problems aana tay hai. Bohot log complain karte hain ki “Salary aati hai aur ek do hafte mein khatam ho jati hai.” Yeh sirf isliye hota hai kyunki budgeting ka system nahi hai.

Budgeting ek roadmap hai jo aapko batata hai ki aapka paisa kaha ja raha hai aur aap kaise save aur invest kar sakte hain. Aaj hum ek simple aur effective budgeting method 50/30/20 Rule ke baare mein jaanenge jo aapke financial goals achieve karne mein madad karega.

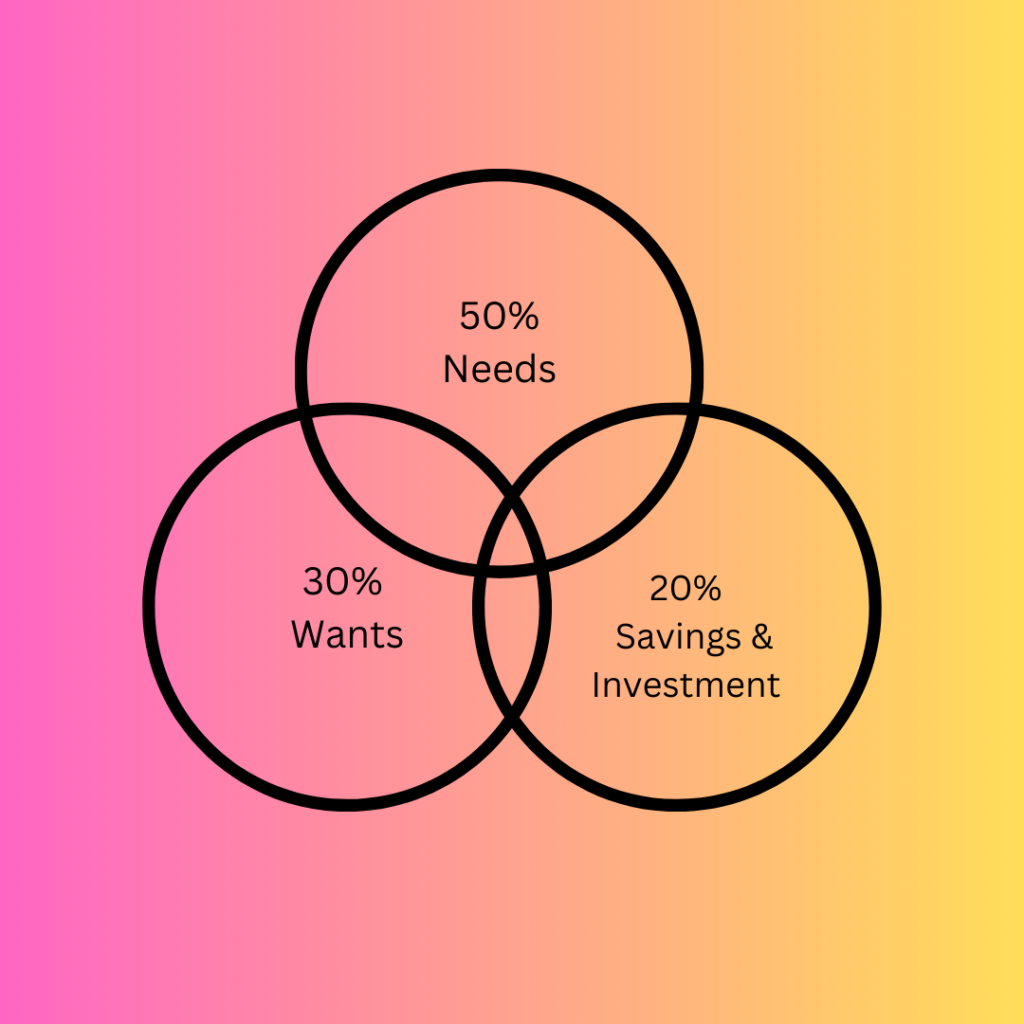

50/30/20 Rule Kya Hai?

Yeh ek simple aur practical budgeting technique hai jo aapki income ko 3 parts mein divide karti hai:

Example:

Agar aapki monthly salary ₹50,000 hai, toh budgeting kuch is tarah hoga:

- ₹25,000 (50%) – Needs

- ₹15,000 (30%) – Wants

- ₹10,000 (20%) – Savings & Investments

Yeh rule follow karne se aap financial stability maintain kar sakte hain aur future secure kar sakte hain.

5 simple steps mai aap apna budegeting kaise plan kare?

Step 1: Apni Monthly Income Calculate Karein

Sabse pehle, aapko apni monthly income (after tax) ka pata hona chahiye. Agar aapke paas side income bhi hai jaise freelancing ya rental income, toh usko bhi add karein.

Step 2: Essential Expenses (Needs) List Karein

Aapki zaroori kharche ka analysis karein aur dekhein ki kitna paisa aapke basic needs par ja raha hai.

✅ Rent / Home Loan EMI

✅ Electricity, Water, Gas Bill

✅ Groceries

✅ Insurance (Health & Term Insurance)

✅ Loan Repayments

Agar aapke expenses 50% se zyada ho raha hai, toh kharcho ko adjust karne ki zaroorat hai.

Step 3: Wants Ke Liye Budget Set Karein

Aapko yeh decide karna hai ki aapko entertainment, shopping, aur lifestyle ke liye kitna paisa allocate karna hai. Agar aapko lagta hai ki unnecessary kharche zyada ho rahe hain, toh isko kam karein.

Step 4: Savings & Investment Priority Banayein

Jo log pehle kharch kar lete hain aur end mein jo bachta hai usko save karte hain, unke paas kabhi bhi savings accumulate nahi hoti. Reverse approach follow karein:

✅ Pehle savings & investment ke liye paisa allocate karein. ✅ Ek Emergency Fund maintain karein (3-6 mahine ka kharcha). ✅ SIPs, Mutual Funds, PPF, Stocks me invest karein.

Agar aapko 20% save karna mushkil lag raha hai, toh atleast 10% se start karein aur dheere-dheere savings increase karein.

Step 5: Apne Expenses Track Karein

Agar aap apne expenses track nahi kar rahe, toh aapko kabhi pata nahi chalega ki aapka paisa kahan ja raha hai.

✅ Google Sheets ya Money Manager Apps use karein.

✅ Cash transactions likhne ki aadat daalein.

✅ Har mahine budget review karein aur necessary adjustments karein.

Common Budgeting Mistakes Jo Aapko Avoid Karni Chahiye

Kya Yeh Rule Har Kisi Ke Liye Suitable Hai?

❌ Sabke liye suitable nahi hai – Har insaan ki financial situation alag hoti hai. Agar aapki fixed expenses zyada hain, toh aap proportion adjust kar sakte hain.

❌ High Cost-of-Living Cities – Bade shehron mein rent aur zaroori kharche zyada hote hain, jisse 50% limit cross ho sakti hai. For example, agar aapka rent zyada hai, toh wants wale expenses ko kam kar ke adjust karna better hoga.

❌ Fixed Rule Approach – Yeh rule flexible nahi hai, aur har kisi ke goals aur needs alag ho sakte hain.

❌ Savings 20% Kam Lag Sakta Hai – Agar aap early retirement ya financial freedom jaldi chahte hain, toh aapko 20% se zyada save karna padega.

Conclusion

Budgeting sirf paisa bachane ka tool nahi hai, balki ek strong financial future banane ka tarika hai.

Agar aap apna 50/30/20 budget plan implement karte hain, toh aap stress-free aur financially secure feel karenge.