Table of Contents

ToggleWhy is budgeting important?

No matter how much you earn, if your money is being spent without any planning, then financial problems are sure to come. Many people complain that “My salary comes in, and within two weeks, it’s gone!”. This happens only because there is no budgeting system.

Budgeting acts as a roadmap, guiding you on where your money goes and how you can save and invest wisely. Today, we’ll explore the 50/30/20 Rule—a simple yet effective budgeting method for salaried individuals to help them achieve their financial goals.

What is the 50/30/20 Rule?

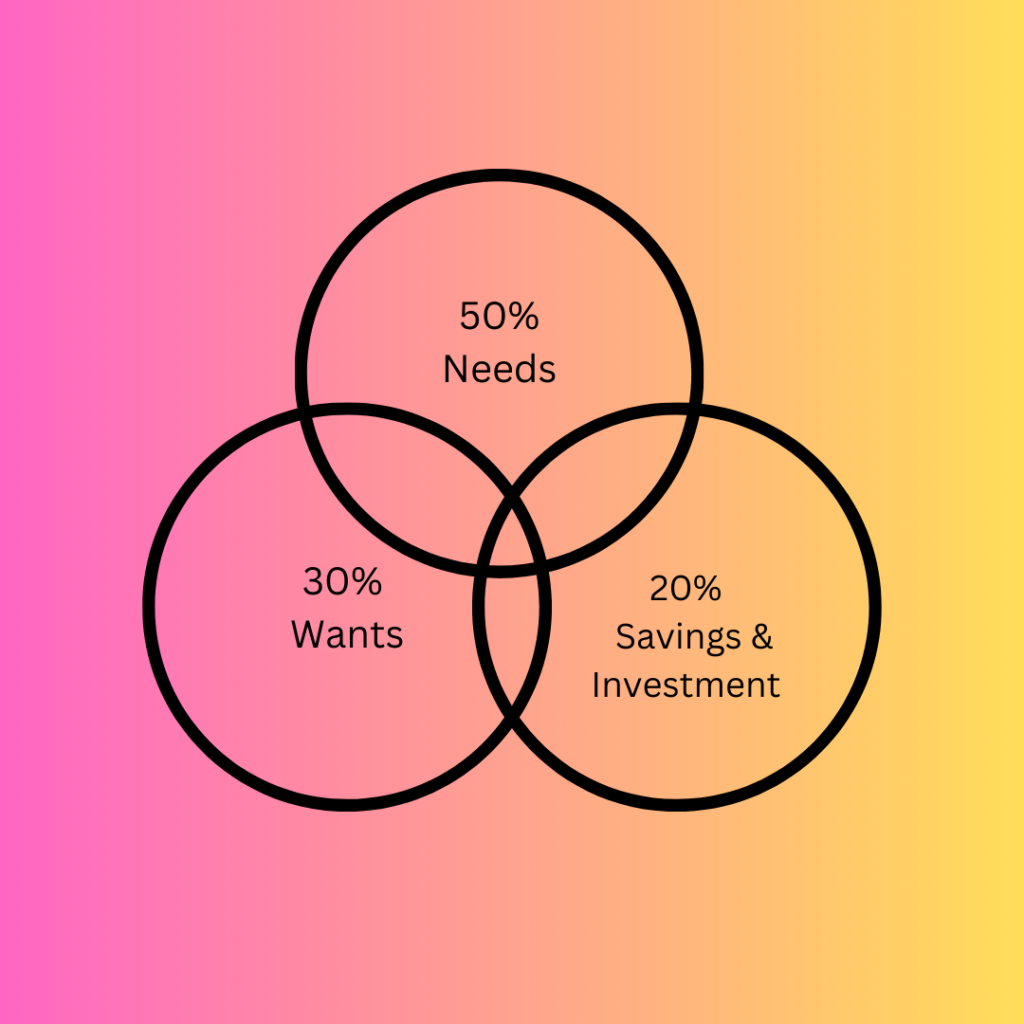

This is a simple and practical budgeting technique that divides your income into 3 parts:

🔹 50% Needs – Rent, groceries, electricity bill, EMI, insurance, medical expenses.

🔹 30% Wants – Shopping, entertainment, restaurants, travel, Netflix subscription.

🔹 20% Savings & Investments – Emergency fund, stocks, mutual funds, PPF.

Example:

If your monthly salary is ₹50,000, then budgeting will be like this:

₹25,000 (50%) – Needs

₹15,000 (30%) – Wants

₹10,000 (20%) – Savings & Investments

By following these rules you can maintain financial stability and secure your future.

How to plan your budgeting in 5 simple steps?

Step 1: Calculate Your Monthly Income

First you should know your monthly income (after tax). If you also have side income like freelancing or rental income, add those.

Step 2: List Essential Expenses (Needs)

Analyze your essential expenses and see how much money is spent on your basic needs.

✅ Rent / Home Loan EMI

✅ Electricity, Water, Gas Bill

✅ Groceries

✅ Insurance (Health & Term Insurance)

✅ Loan Repayments

If your expenses are increasing by more than 50%, then there is a need to adjust the expenses.

Step 3: Set Budget for Wants

You have to decide how much money you want to allocate for entertainment, shopping, and lifestyle. If you feel that unnecessary expenses are increasing, then reduce them.

Step 4: Making Savings & Investment Priority

People who spend first and save what is left at the end, their money never accumulates savings. Reverse approach should be followed:

✅ First allocate money for savings & investment.

✅ Maintain an emergency fund (3-6 months’ expenses).

✅ Invest in SIPs, Mutual Funds, PPF, Stocks.

If you are finding it difficult to save 20%, then start with at least 10% and gradually increase your savings.

Step 5: Track Your Expenses

If you don’t track your expenses, you’ll never know where your money is going.

✅ Use Google Sheets or Money Manager Apps.

✅ Get into the habit of recording cash transactions.

✅ Review the budget every month and make necessary adjustments.

Common Budgeting Mistakes You Should Avoid

🚫 Saving only the money saved after spending – Giving first priority to savings.

🚫 Relying on credit card – Try to avoid EMI and unnecessary debt.

🚫 Impulsive shopping – Before buying every small thing, think about whether it is necessary.

🚫 Delaying financial planning – Start today, starting early is always better.

Is this rule suitable for everyone?

❌ Not suitable for everyone – Every person’s financial situation is different. If your fixed expenses are high, you can adjust the proportion.

❌ High Cost-of-Living Cities – Rent and essential expenses are high in big cities, which can exceed the 50% limit. For example, if your rent is high, it would be better to adjust the wants by reducing the expenses.

❌ Fixed Rule Approach – This rule is not flexible, and everyone’s goals and needs may be different.

❌ Savings can be less than 20% – If you want early retirement or financial freedom, then you will have to save more than 20%.

Conclusion

Budgeting is not just a tool to save money, but a way to build a strong financial future. If you implement your 50/30/20 budget plan, you will feel stress-free and financially secure.