5 Pillars of Personal Finance – Apne Paiso Ka Behtar Future Secure Karo!

Agar aap apni salary milte hi poori kharch kar dete ho, month-end ane tak aapke account mai savings nahi hai, aur emergency ke waqt paise ki tension hoti hai, toh personal finance aapko samajhna bahut zaroori hai!

Sochiye, agar aapke paas ek strong financial plan ho—savings bhi ho, investment bhi, aur emergency fund bhi—tab life kitni stress-free ho sakti hai! Yeh article aapko personal finance ke 5 basic components samjhane wala hai and aapko paiso ka sahi management sikhayega taki app financially strong ban sakein. 🚀

Personal finance kya hai ?

Personal finance ka matlab hai aapke income, expenses, savings, investments aur debt ko sahi tareeke se manage karna. Agar aap financial freedom chahte hain, toh personal finance ki samajh hona bohot zaroori hai.

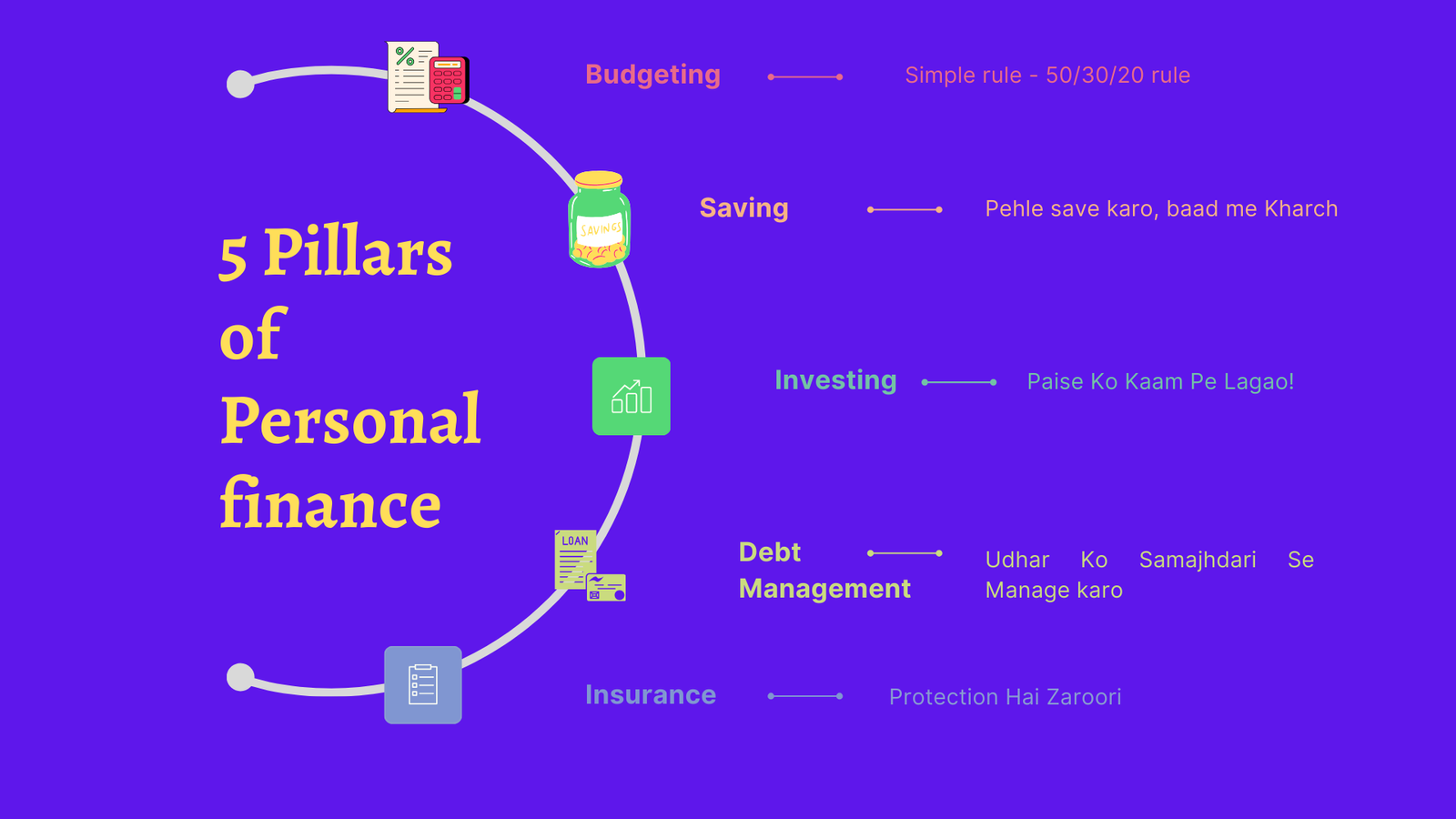

5 Pillars of Personal finance:

1. Budgeting – Paise Ka Sahi Hisab

Budgeting ka matlab hai income aur expenses track karna taaki aap extra kharche control kar sako.

Simple rule – 50/30/20:

✅ 50% zaroori kharche (Rent, Bills, Food)

✅ 30% optional kharche (Shopping, Entertainment)

✅ 20% savings & investment

💡 Tip: Notebook, Budgeting apps ya Excel sheet use karo taaki paiso ka sahi management aap regularly track kar sakho.

2. Saving – Aaj Paise Bachaoge, Kal Kaam Aayega!

Saving ka matlab hai future ke liye paisa side rakhna taaki emergencies aur short-term goals manage ho sakein.

Emergency Fund – Atleast 3-6 mahine ke expenses save karna jaroori hai (Fixed Deposit ya Liquid mutual funds best hai).

Short-Term Goals – Travel, gadgets ya education ke liye alag savings rakho (Savings account sahi hai).

Rule: Pehle save karo, baad me kharch!

3. Investing – Paise Ko Kaam Pe Lagao!

Sirf saving se kaam nahi chalega, invest karna zaroori hai taaki paisa badh sake.

✔ Stocks, Mutual Funds, Index Funds – Long-term wealth create karne ke liye.

✔ PPF, NPS, Gold Bonds – Secure aur tax-saving investments.

✔ SIP vs. Lumpsum – SIP me har mahine invest karo taaki risk kam ho.

💡 Tip: Jaldi shuru karo, compounding ka faida uthao!

4. Debt Management – Udhar Ko Samajhdari Se Sambhalo

Agar aapke paas loan ya credit card ka udhar hai, toh usko priority se pay off karo:

✔ High-Interest Debt Pehle Khatam Karo – Jaise credit card dues.

✔ EMI 30-40% Se Zyada Nahi Honi Chahiye – Taaki financial stress na ho.

✔ Snowball vs. Avalanche Method – Chhoti loans ya high-interest loans pehle pay off karo.

📢 Golden Rule: Jitni jaldi udhar khatam, utna accha financial future!

5. Insurance – Protection Hai Zaroori

Bina insurance ke financial planning adhura hai!

✔ Term Life Insurance – Agar aap earning member ho toh life insurance lena must hai. Ye family ko financially secure rakhta hai.

✔ Health Insurance – Medical emergencies unpredictable hoti hain. Ek achha health cover lo taaki hospital bills se bach sako.

💡 Tip: Insurance expense nahi, zaroorat hai! Pehle insure karo, phir invest karo.

Common Financial Mistakes Jo Aapko Avoid Karni Chahiye

❌ Expense track nahi karna

❌ Sirf kamaana, lekin save aur invest nahi karna

❌ Bina soche credit card use karna

❌ Bina soche personal loan lena

❌ Insurance ignore karna – sabse badi mistake

Actionable Steps – Aaj Hi Start Karo!

✅ Apna budget set karo aur expense track karna shuru karo. (Excel, budget tracking tool, notebook)

✅ Har mahine kuch na kuch save karo. (Minimum 10% aapke salaray ka)

✅ Small amount se investing start karo (Mutual Funds, ETF, Bonds, Stocks)

✅ High-interest debt se jaldi chutkara pao (credit card loans and personal loans)

✅ Health aur term insurance lo (bohot jyada jaroori hai)

Conclusion – Pehla Kadam Aaj Hi Uthao!

Agar aap apne paise ka sahi management seekh liya, toh financial problems kabhi nahi aayengi. Budgeting, saving, investing, debt management aur insurance ka balance banake aap ek strong financial future bana sakte hain. Aaj hi shuru karo aur apne financial goals achieve karo!